Cointelegraph’s 2021 report on security tokens explains how bond and stock tokenization works, how many assets have already been tokenized, what returns they have provided, and how they are regulated in different countries.

Is security tokenization the next killer application of blockchain technology? Bankers at Raiffeisen Bank International argue that by 2030, most securities will have been tokenized. To gain a deeper understanding of how blockchain technology can transform traditional stock exchanges, this study has compiled a dataset of all security token offerings and found that almost $5 billion was raised in 2020. The report estimates that the global market capitalization for tokenized securities will have surpassed $1 billion by the end of 2021 and that approximately $9.5 trillion will have been invested in tokenized stocks by the end of 2025.

Key topics covered in this six-chapter and 90-page report include:

-

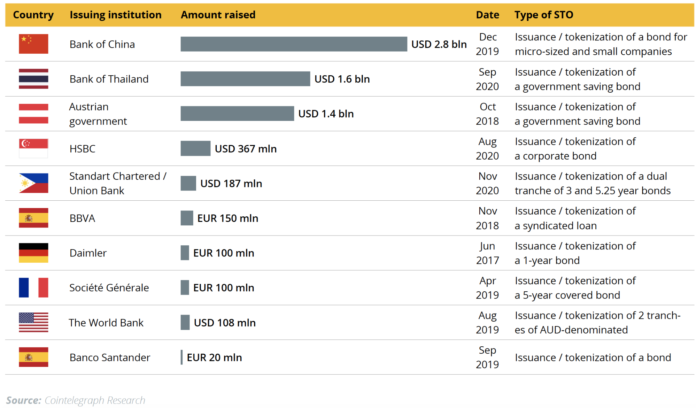

One of the largest trends is governments and corporations tokenizing their debt and issuing bonds to investors on blockchains, such as Ethereum and Tezos. Approximately $6.9 billion in tokenized debt has been successfully issued since 2017.

-

The daily trading volume for tokenized traditional stocks, such as Tesla (TSLA), Coinbase (COIN), GameStop (GME) and Apple (AAPL), surpassed $4 million in one day on the cryptocurrency exchanges Binance and FTX in early May versus $3.9 million for tokenized securities such as Mt Pelerin (MPS), RealT (multiple tokens) and Tzero Group (TZROP) for the whole month of April on the security token exchanges tZERO, Merj, Open Finance Network and TokenSoft.

-

The global market capitalization for security tokens, such as Blockchain Capital’s BCAP, MPS, RealT’s tokens and TZROP is hovering around $700 million. We estimate this to have surpassed $1 billion by the end of Q3, 2021.

Source: Cointelegraph Research, CryptoResearch.Report

Supported by Crypto Finance, Bitpanda Pro, Coinfinity, Ten31 Bank, Riddle&Code,

HyperTrader, Blocklabs Capital Management, Stadler Völkel and Elevated Returns, this landmark study was written by 13 authors in six countries including Demelza Hays, Ph.D.; Lee Schneider from the general council for EOS’s Block.one; Dr. Lewin Boehnke and Dominik Spicher from Crypto Finance; Martin Liebi and Silvan Thoma from PricewaterhouseCoopers; Katharina Gehra from Immutable Insight GmbH; Andy Flury from AlgoTrader; Ivor Colson from Tokeny; Marius Smith of Finoa; Bryan Hollmann and Oliver Völkel from Stadler Völkel Attorneys at Law; Urszula McCormack from King & Wood Mallesons, among others.