Summary

The buzzwords associated with Web3 have been thrown into pitch decks, company names, and websites reminiscent of the dot.com era; Blockchain, Cryptocurrency, NFTs, and Metaverse.

These technologies will be utilized to shift today’s internet to a decentralized infrastructure more resilient to the corporate issues of today. In Web3, code is law.

Thematic ETFs are a relatively low-cost, tax-efficient vehicle to access an institutional portfolio in technology that will power our future.

The cryptocurrencies, blockchains, and Web3 projects of today may or may not be relevant in the future but the technology and newly designed infrastructure will be with us for the foreseeable future.

Thesis: Cyber security, mobile payments, video game technology, and global cloud computing will all be part of tomorrow’s global infrastructure and stand to benefit and outpace other market segments as adoption of Web3 technologies continues to grow.

The opportunity is not blockchain, cryptocurrency, NFTs or even the metaverse. These are individual parts of a much larger and holistic emerging tech opportunity known as “Web3.”

Technology continues to evolve, bringing more benefits to society with every step of advancement (i.e., improved healthcare, global communication and connection with loved ones, instant access to libraries of knowledge from recorded history).

However, the infrastructure that we are dependent on to run today’s society has shown to be imperfect with total reliance on companies and organizations that limit individual control.

Web2, our current version of the internet, has morphed into an oligopoly of major tech firms and we, as the consumer, are at the behest of human error and imperfect infrastructures built for a less technologically advanced society.

A Brief History of the Internet

The early 90s sparked the adoption of a new generation of technology focused on connecting the world through an interactive network known as the World Wide Web (WWW). To many, this early-stage internet can be summed up in three words, “you’ve got mail”.

Email, static websites and sharing photos were the earliest iteration of what the internet was for, Web1. The transition to Web2, known as the dot-com era, was aggressive and short-lived. Cycles of fast exponential growth followed by consolidation caught many tech companies by surprise and were unable to adapt to the changing tides, being replaced by the tech giants of today.

In Web2, billions of people every day convene on interactive websites baking them into the infrastructure of today’s society. Schools, Police departments, and local businesses rely on the connectivity of a few companies to educate, protect, and serve communities around the world.

Web3 Technologies

The buzzwords associated with Web3 have been thrown into pitch decks, company names, and websites reminiscent of the dot.com era; Blockchain, Cryptocurrency, NFTs, and Metaverse.

These technologies will be utilized to shift today’s internet to a decentralized infrastructure more resilient to the corporate issues of today. In Web3, code is law.

The new code and processes built for Web3 create opportunities for self-custody and trust-less transactions for B2B, B2C, and peer-to-peer alike, removing unnecessary fees and lag time built into solutions for yesterday’s problems. This aging tech infrastructure has led the way to new problems creating an environment ripe for innovation and disruption.

The momentum behind the Web3 surge is putting into action a belief that technological advancements can be the very tool to liberate our digital lives, and provide true monetary and asset ownership through self-custody, IP and identity security all without needing a classic corporate tech giant at the helm.

The two most widely known and reported blockchains are Bitcoin and Ethereum. With publicly accessible distributed ledger technology (DLT), these networks of nodes/computers are decentralized solutions to storing pertinent information with many digital copies – thousands of copies.

Because of this redundancy, the network can’t be taken down due to poor management or power outages. If Amazon (AMZN) has server issues, roughly a third (33%) of the internet is taken offline.[1] In fact, it happened in 2021, twice.

Meta (formerly Facebook) (FB) had power issues shutting down all their global services for hours leaving schools unable to communicate with parents, police departments unable to update their communities, and businesses unable to conduct commerce.

This creates a socioeconomic infrastructural need to move away from the current system relying on just a few tech oligarchs. “Smid-cap” (small- to mid-cap) tech firms stand to benefit the most, long term, as they fill this need for decentralization of the infrastructure that runs our digital lives.

New Technologies from Familiar Markets

The transition from Web1 to Web2 was abrupt with new companies replacing the old. The transition to Web3 will be more like an evolution, a gradual adoption and implementation offering opportunities for the aforementioned smid-cap tech firms to become a necessary part of our (near) future digital infrastructure.

Investment Opportunities

Thematic ETFs are a relatively low-cost, tax-efficient vehicle to access an institutional portfolio in technology that will power our future. Markets have been a little crazy lately, but people have predictable habits. I want you to count how many of your daily habits require access to the internet.

If that isn’t reason enough, think of the “great wealth transfer” due to hit in the next 2 decades. This will fund younger generations to do more of what they do, and adopt new technologies that streamline the connection between their physical and digital worlds.

A lack of regulatory infrastructure and investor safeguards like FDIC/SIPC opens many opportunities for product quality issues. Many projects have been found to be scams, founders that are anonymous through aliases and unable to be held accountable for fraudulent activities, and uncouth behavior unbecoming of anyone deserving of your investment.

The cryptocurrencies, blockchains, and Web3 projects of today may or may not be relevant in the future but the technology and newly designed infrastructure will be with us for the foreseeable future.

There are plenty of publicly traded companies held to generally accepted accounting practices (GAAP) that will aid in ushering in this new era. Unlike the previous internet evolution from Web1 to Web2, we have new financial technologies to allow institutions and retail investors single stock simplicity in a transparent vehicle, ETFs, allowing them to get early exposure across emerging global themes in a diversified portfolio dedicated to a specific theme.

Cyber Security (Ticker: HACK)

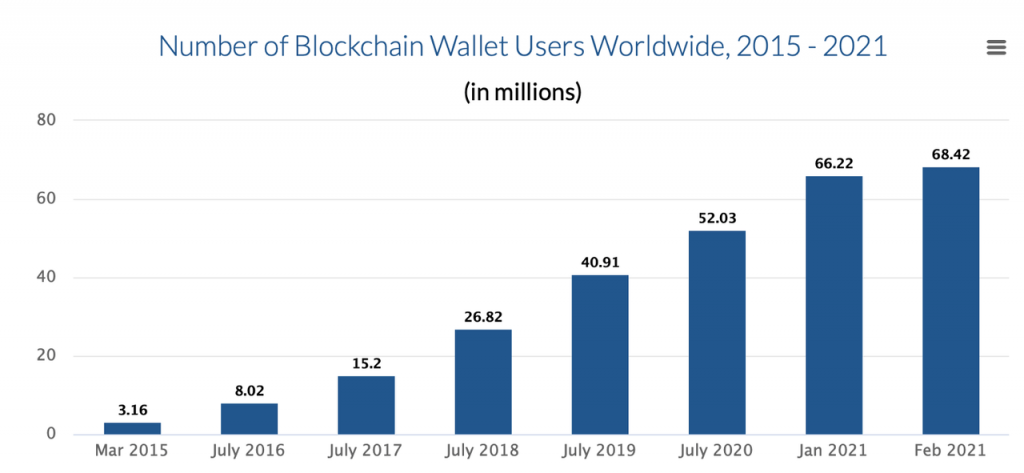

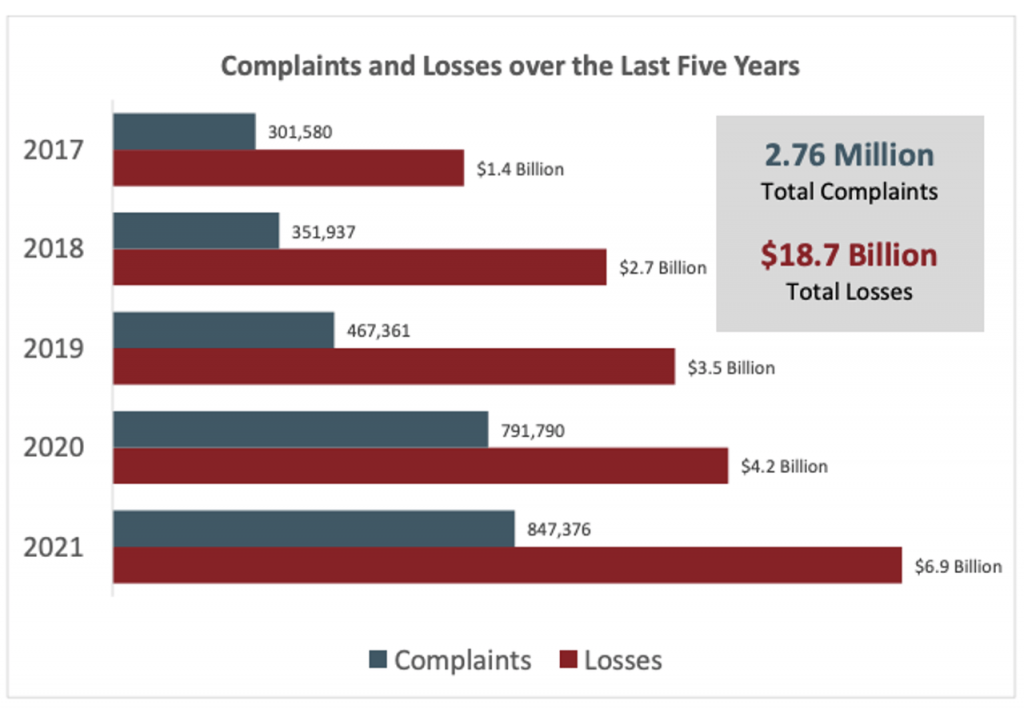

Cyber security has been a growing interest for businesses and municipalities alike. Corporate espionage and a new set of “front lines” in the face of war have created a need for high-level digital security. With the birth of Bitcoin, a proof-of-concept that digitally-centric assets are feasible, consumers will need to become aware and adopt a new set of habits designed to keep their digital lives secure.

A portfolio of cyber security firms stands to benefit throughout the transition to Web3 and beyond. Computers, cellphones, and real-world critical infrastructure have all been in focus and the target of cyber criminals for years. Add a pinch of “self-custody digital assets” and a dash of “new internet-based global infrastructure” to prey on bad cyber actors and have a fresh serving of digital ratatouille.

(Chart of increased cyber criminal activity with value stolen/at risk)

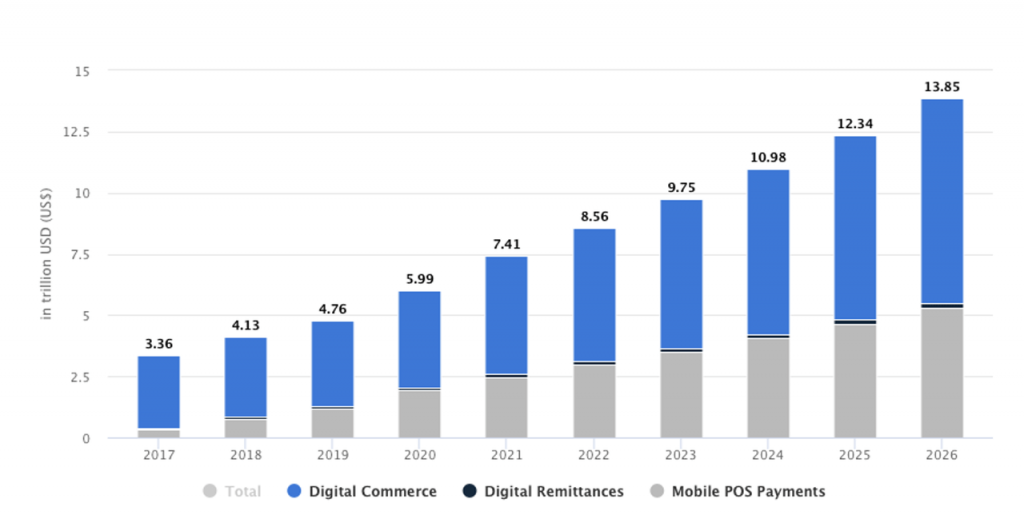

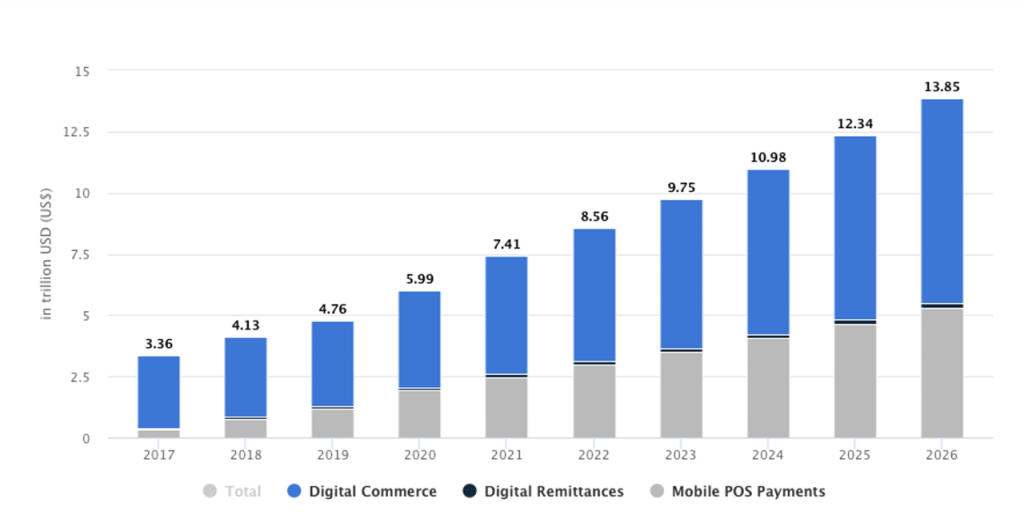

Mobile payments companies have built a global network for digital transactions across physical brick & mortar stores and websites alike. In 2021, 82% of Americans were predicted to use digital payments via browser-based or in-app purchases, in-store checkout with mobile apps and/or QR codes, and popularized P2P payment services.[2]

Many companies providing these services are building in cryptocurrency compatibility due to the accelerating adoption around the world of digital assets. This financial infrastructure is paramount to bridging traditional assets with new digital assets for a streamlined transaction experience.

Video Game Tech (Ticker: GAMR)

Video game technology and platforms are currently best equipped to help brands enter the metaverse due to a pre-existing and loyal user base accustomed to consuming in the virtual space.

Brands like Nike, Gucci, Nerf, Chipotle, and the NFL have all partnered with gaming companies to create digital consumer products for strategic positioning for increased digital consumption. You will not be required to “enter the metaverse” but recent history has told us that more and more consumers are choosing to, all on their own.

As this new digital escape continues to evolve and become more interactive with today’s physical world, adoption will continue to grow and be adopted at an accelerated pace.

Cloud Services (Ticker: IVES)

Internet-connected servers and databases accessible from anywhere in the world, “The Cloud,” has allowed employees to work from anywhere with the same access to knowledge and company resources as if they were sitting in their company headquarters.

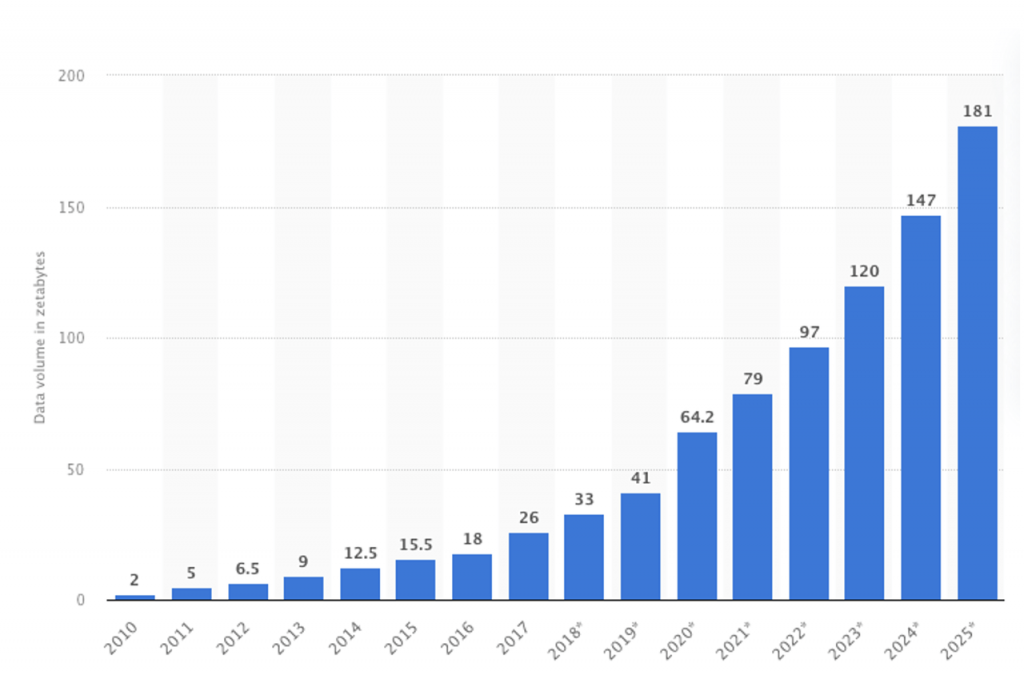

The idea of remote work spread like wildfire when the globe was blindsided by the 2020 pandemic. When Amazon and Meta go offline the infrastructure is broken leaving smid-cap global cloud firms the opportunity to be the decentralized infrastructure necessary for today’s societal needs. Data is due for exponential growth through the end of the decade with no projects of slowing down.

Conclusion

Using thematic ETFs, investors can access the Web3 space and seek to capitalize on the exponential growth of adoption of the associated technologies through traditional markets with the aid of industry experts and commonly used metrics for investment decisions.

Cyber security, mobile payments, video game technology, and global cloud computing will all be part of tomorrow’s global infrastructure and stand to benefit and outpace other market segments as the adoption of Web3 technologies continues to grow.

Social shifts on a worldwide scale take time but offer exponential growth to high conviction investors. Volatility is inevitable in the new market segments and is never easy. If it were easy, there would be no wealth gap.

Definitions

Blockchain: A blockchain is a distributed database that is shared among the nodes of a computer network.[3]

Cryptocurrency: A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.[4]

NFT (Non-Fungible Token): (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

Metaverse: The metaverse is a digital reality that combines aspects of social media, online gaming, augmented reality (AR), virtual reality (VR), and cryptocurrencies to allow users to interact virtually